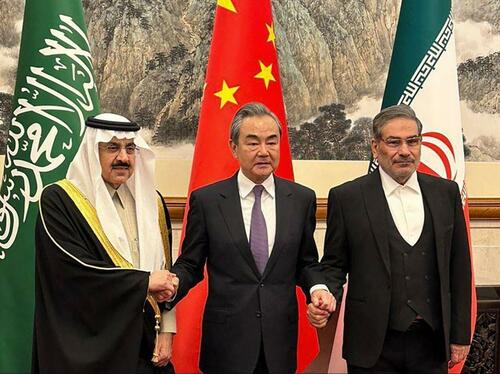

Iran-Saudi Rapprochement Will Deal a Deathblow to the Dollar

Eurasia’s geo-economic integration took a great leap forward as a result of the Iranian–Saudi rapprochement, which unlocks the Gulf Cooperation Council’s (GCC) trade potential with Russia and China. Its wealthy members can now tap into two series of Iranian-transiting megaprojects in one fell swoop through this deal, with the North-South Transport Corridor (NSTC) connecting them to Russia while the China-Central Asia-West Asia Economic Corridor (CCAWAEC) will do the same vis-à-vis China.

The bloc’s de facto Saudi leader has been prioritizing a comprehensive economic reform policy known as “Vision 2030” that was introduced by Crown Prince and first-ever Prime Minister Mohammed Bin Salman (MBS) upon his rise to power in 2015. It regrettably stumbled as a result of the disastrous Yemeni War that he’s been waging since that same year, but everything is now back on track and more promising than ever after securing $50 billion worth of investments from China last December.

The People’s Republic regards Vision 2030 as complementary to its Belt & Road Initiative (BRI) due to MBS’ focus on real-sector investments for preemptively diversifying the Saudi economy away from its presently disproportionate dependence on oil exports. His country’s location at the crossroads of Afro-Eurasia also makes investments there extremely attractive from the perspective of China’s logistical interests, hence its massive commitment to his comprehensive economic reform policy.

Without last week’s Beijing-brokered deal, China would have had to rely on maritime routes under the control of the powerful US Navy to facilitate the forthcoming explosion in bilateral real-sector trade, but now everything can be conducted much more securely via the Iranian-transiting CCAWAEC.Looking forward, there’s also a theoretical possibility of Chinese energy investments in Iran connecting the Gulf to Central Asia and thenceforth to the People’s Republic, thus fully securing its strategic interests.

That’s still a far way’s off, if it even happens at all that is, but it nevertheless can’t be ruled out. Saudi Arabia’s desire to join BRICS and the SCO, which are the most influential multipolar organizations in the world right now, could turn this scenario into a reality a lot sooner than even the most optimistic observers might have expected. All of this in and of itself will herald a revolution in geo-economic affairs, and that’s even without Saudi Arabia having yet to throw its full support behind the “petroyuan”.

Once this major oil exporter begins to sell its resources in non-dollar-denominated currencies like China’s, then the petrodollar upon which the economic-financial aspect of the US’ unipolar hegemony is predicated will be dealt a deathblow. The global systemic transition to multipolarity and the impending trifurcation of International Relations that will precede the final inevitable form of this process would unprecedentedly accelerate once this happens, thus further hastening America’s ongoing demise.

About those aforementioned processes, they were already made irreversible by the special operation that Russia was forced to commence in defense of its national security red lines in Ukraine after NATO clandestinely crossed them there and subsequently rejected Moscow’s security guarantee requests for politically resolving their resultant security dilemma. Over the past year, the New York Times was forced to admit that not only did the sanctions fail, but even the plot to “isolate” Russia did too.

These outcomes were largely the result of Russia’s example inspiring the Global South to rise up against neo-colonialism by refusing to comply with the demands placed upon them by the US-led West’s Golden Billion to unilaterally sacrifice their own interests simply to serve that de facto New Cold War bloc’s. India played the leading role in this respect due to its status as the world’s largest developing country, which gave comparatively medium- and smaller-sized ones the confidence to follow in its footsteps.

That globally significant Great Power, which sits on the South Asian end of the NSTC that transits through Iran en route to Russia, also scaled up its purchases of discounted oil from Moscow to the point where its decades-long strategic partner is nowadays its largest supplier. Of crucial significance to the present analysis, a growing number of its deals are in non-dollar-denominated currencies, which sped up de-dollarization processes to such an extent that even Reuters felt compelled to write about this.

Considering this newfound financial context, there’s no doubt that upcoming Saudi moves in support of the petroyuan that are taken in coordination with Iran and Russia would catalyze the next natural phase of de-dollarization. Russian-GCC real-sector trade that’ll be carried out via Iran across the NSTC will be conducted in national currencies and thus prepare those three for the moment when they finally decide to deal a deathblow to the petrodollar.

All in all, it’s not hyperbole to declare that the dollar’s prior dominance is done for as a result of the Iranian-Saudi rapprochement. That Beijing-brokered deal makes this outcome an inevitability unless some subversive black swan event takes place such as a US-backed coup against MBS, though that’s unlikely to happen after he successfully consolidated his power in late 2017. With this in mind, it can confidently be declared that that last week’s development will be seen in hindsight as a game-changer.