Fitch May Reassess China’s A+ Credit Rating if Debts Balloon as Economy Falters

Confidence across China’s financial markets is declining by the week as the People’s Bank of China injected the largest amount of short-term cash since February, one day after it cut interest rates. We penned a note overnight titled With China’s Economy On “Verge Of Collapse,” PBOC Central Banker Calls For Helicopter Money, outlining the deteriorating conditions in the world’s second-largest economy. Now Fitch Ratings has warned it may reconsider China’s A+ sovereign credit rating should its non-government debt liabilities balloon.

“We might think again, because the debt-to-GDP ratio is a little bit on the high side for a single ‘A’ credit,” if China decides to expand its balance sheet to support the economy, James McCormack, global head of sovereigns, told Bloomberg TV, on Wednesday. He doesn’t expect an imminent downgrade but noted that an increase in corporate and banking sector debt could become “real liabilities for the government.”

McCormack continued, “So if it really does extend its balance sheet to support the economy — and I wouldn’t say we’re expecting that, certainly recent evidence doesn’t suggest that that will be the case — then we might think again because the debt to GDP ratio is a little bit on the high side for a single ‘A’ credit.”

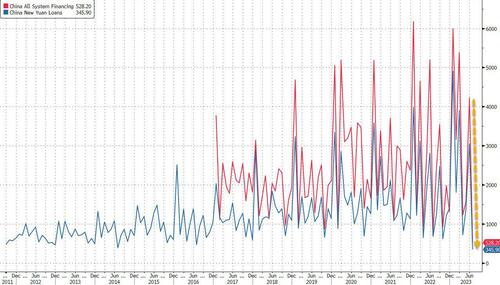

On Sunday, China’s new loans tumbled in July to the lowest since 2009.

On Tuesday, the People’s Bank of China cut interest rates on one-year loans — the medium-term lending facility — by around 15 bps to 2.5%, the most significant cut in three years. The move to stimulate the economy comes as the recovery appears to falter.

Rabobank’s Michael Every cites the Economic Observer, a subsidiary of Xinhua News Agency, which published a newsletter titled “Finance Bureau Chiefs in the Past Half Year,” and which concluded that local government finances and the national economy are reportedly “on the verge of collapse, and the thunder will explode at any time.” The dominos appear to be falling:

- Country Garden just defaulted;

- Zhongzhi Enterprise Group missed payments on high-yield investment products;

- recent bank loan data were terrible;

- and today saw industrial production 3.7% y-o-y (4.3% expected),

- retail sales 2.5% y-o-y (vs. 4.0%),

- fixed asset investment 3.4% y-o-y year-to-date (vs. 3.7%),

- property sales -8.5% y-o-y year-to-date (vs. -8.1%),

- and unemployment 5.3% vs. 5.2% (not to mention that youth unemployment which just hit all time highs, will no longer be reported for obvious reasons).

Evidently, the move to stimulate the economy suggests policymakers are in a panic. It’ll be more challenging than ever to stimulate the economy because of the country’s massive debt load. Becky Liu, head of China macro strategy at Standard Chartered Bank, noted, “Aside from helicopter money, nothing seems to be very effective so more aggressive actions will be needed to avert this downward momentum.”

And Fitch is taking notice as to why it appears McCormack was floating a trial balloon on Bloomberg today about the risks of a China downgrade if non-government debt liabilities worsen.

McCormack’s comments about China come weeks after ratings agency downgraded the US and warned major US banks are at risk of downgrades.