Gold Vs. Bitcoin: Comparing The Top 10 Monetary Characteristics

Authored by Nick Giambruno via InternationalMan.com

Given the characteristics of gold and Bitcoin, which is best suited for sending value through time and space?

Below, I’ll analyze the ten most decisive monetary attributes and see whether gold or Bitcoin has an advantage.

Monetary Attribute #1: Scarcity

The World Gold Council estimates there are 6.8 billion ounces of mined gold globally, and annual production averages around 118 million ounces.

That much is what is known. However, we don’t know how much gold will be discovered and mined in the future.

For example, how many mined ounces of gold will be available on June 1, 2031?

We can probably make a pretty accurate projection, but nobody can know.

What will the Bitcoin supply be on June 1, 2031?

It will be around 20,589,121 Bitcoins.

With Bitcoin, the current and future supply is finite and known to all.

There will never be more than 21 million Bitcoins, and there is nothing anyone can do to change that.

Today, the Bitcoin supply is about 19.6 million, meaning the vast majority—over 93%—of the total Bitcoin supply has already been created.

The remaining 1.4 million BTC will come onto the market at a preset, ever-decreasing rate until the last Bitcoin is created 116 years from now, in 2140.

In other words, Bitcoin’s supply will only grow about 7% in the next 116 years.

The supply of Bitcoin won’t grow much at all from here.

By 2030, over 98% of all Bitcoins will have already been created.

Bitcoin_apex, a German Bitcoin advocate, describes Bitcoin’s scarcity like this:

8 billion people, 21 million Bitcoin.

That is proportionally as if:

80,000 people had to share $210.

8,000 people spread out on a bus with 21 seats.

800 people would share 2.1kg of bread.

80 people sharing 0.21 liters of water.

8 people would have to live in an apartment with 0.021 square meters.

Here’s another way to think of it.

Owning 1 BTC is like owning 324 ounces of the global gold supply; each would give you ownership over about 0.00000476% of the overall supply.

Owning 1.236 BTC is like owning a 400-ounce Good Delivery gold bullion bar; each would give you ownership over about 0.0000059% of the overall supply.

Here’s the bottom line.

Gold is scarce, but only Bitcoin is absolutely scarce.

Verdict: Bitcoin Wins

Monetary Attribute #2: Hardness

In my view, hardness is the most important monetary attribute.

Hardness does not mean something that is necessarily tangible or physically hard, like metal. Instead, it means “hard to produce.” By contrast, “easy money” is easy to produce.

The best way to think of hardness is “resistance to debasement,” which helps make it a good store of value—an essential function of money.

All other monetary characteristics are meaningless if the money is easy for someone to produce.

What is desirable in a good money is something that someone else cannot make easily.

For example, imagine the price of copper going 5x or 10x.

You can be sure that would spur increased production, eventually expanding the copper supply. Of course, the same is true of any other commodity.

That’s why there is a famous saying in mining: “The cure for high prices is high prices.”

The dynamic of higher prices incentivizing more production and ultimately more supply, bringing prices down, exists with every physical commodity. However, gold is the most resistant to this process.

That supply response is why most commodity prices tend to revert around the cost of production over time.

This dynamic is even more profound with money.

When an asset obtains monetary properties, the natural reaction is for people to make more of it—a lot more of it.

This is known as the easy money trap.

Historically, gold was always the hardest asset, the one most resistant to the easy money trap… until Bitcoin.

Bitcoin is the first—and only—monetary asset with a supply entirely unaffected by increased demand.

That is an astonishing and game-changing characteristic.

That means the only way Bitcoin can respond to an increase in demand is for the price to go up. Unlike gold and every other commodity, increasing the supply in response to increased demand is not an option.

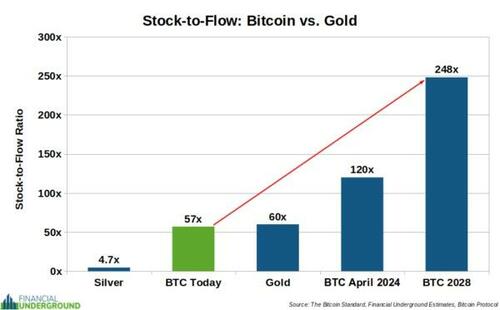

The stock-to-flow (S2F) ratio measures an asset’s hardness.

S2F Ratio = Stock / Flow

The “stock” part refers to the amount of something available, like current stockpiles. It’s the supply already mined. It’s available right away.

The “flow” part refers to the new supply added from production and other sources each year.

A high S2F ratio means that annual supply growth is small relative to the existing supply, which indicates a hard asset resistant to debasement.

A low S2F ratio indicates the opposite. This means that new annual production can easily influence the overall supply and prices, which is not desirable for something that functions as a store of value.

Before I move on, it’s important to clarify that hardness is not the same as scarcity. They are related concepts but not the same thing.

For example, platinum and palladium are scarcer than gold but not hard assets. Current production is high relative to existing stockpiles.

Unlike gold, stockpiles of platinum and palladium have not built up over thousands of years. It’s the primary reason why new supply can easily rock the market.

Because of their low S2F ratios, platinum (0.4x) and palladium (1.1x) are not suitable as money. Their low S2F ratios indicate they are primarily industrial metals, corresponding to how people use them today. Almost nobody uses platinum and palladium as money.

Gold has an S2F ratio of 60x. That means it would take about 60 years of the current production rate to equal the existing gold supply.

Today, Bitcoin’s S2F ratio is about 57x, slightly below gold’s.

According to its fixed protocol, we know precisely how Bitcoin’s supply will grow in the future.

A key feature is that the new supply gets cut in half every four years, which causes Bitcoin’s hardness to double every four years. This process is known as the “halving.”

The next time Bitcoin’s supply growth will be cut in half will be in April 2024.

But this coming halving will be very different…

That’s because Bitcoin’s hardness will be almost twice that of gold’s when that happens.

That’s how Bitcoin will soon become the hardest money the world has ever known. And it will keep getting harder as its S2F ratio approaches infinity.

For thousands of years, gold has always been mankind’s hardest money. That is all set to change in a few weeks, and most people have no idea.

Verdict: Bitcoin Wins