Oil Tanker Shortage Emerges After Red Sea Crisis Disrupts Global Trade

The Red Sea shipping crisis has been an explosive mess for the international shipping community and the global economy. With oil tankers increasingly steering clear of the southern Red Sea and the Bab el Mandeb Strait, shipping capacity has rapidly tightened, pressuring daily rates higher.

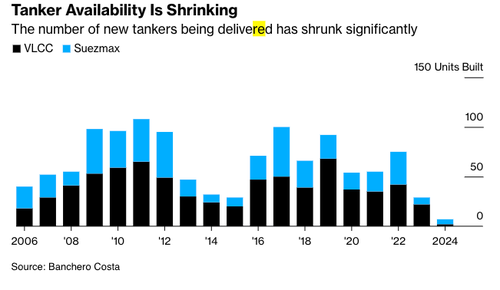

Only two new supertankers will join the global fleet in 2024, the fewest additions in forty years and about 90% below the yearly average over the last two decades.

“The impact of the diversions can be seen every day in shipping in general, and I would say crude oil and product tanker shipping,” specifically, Alexander Saverys, CEO of Euronav NV, one of the largest tanker owners in the world, told investors during an earnings call earlier this month.

Saverys said low deliveries and an aging global fleet are a perfect recipe for a positive outlook on tankers.

We have stated that Houthi attacks on commercial shipping are the “next supply-driven inflation shock.” As a result, a key Clean Tanker rate tracked by the Baltic Exchange has moved north of $100,000 per day due to the disruptions, caused longer sails, which tightens capacity on the seas.

The US and UK airstrikes on Houthi militants in Yemen were one of the major drivers that sent tanker rates soaring in the second half of January. Many of these tankers, hauling fuels like gasoline and diesel, have been forced to navigate around Africa.