The West Is Losing Control Over the Gold Price

An important change has unfolded in the global gold market. The East has been driving up the gold price, predominantly in late 2022 and the first months of 2023, breaking the West’s long-standing pricing power.

Until recently, Western institutional money was driving the price of gold in wholesale markets such as London, mainly based on real interest rates. Gold was bought when real rates fell and vice versa. However, from late 2022 until June 2023 gold was up 17% while real rates were more or less flat, and Western institutions were net sellers. Most likely, Eastern central banks, and Turkish and Chinese private demand, lifted the price of gold.

For about ninety years, up until 2022, there was a pattern of above-ground gold moving from West to East and back, in sync with the gold price falling and rising. Western institutions set the price of gold and bought from the East in bull markets. In bear markets, the West sold to the East. For more information read my article: The West–East Ebb and Flood of Gold Revisited.

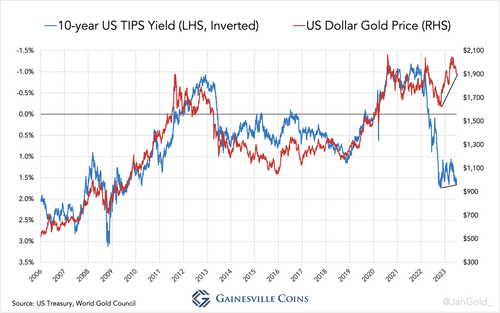

If we zoom in on the period from 2006 through 2021 the main reason for Western institutions to buy or sell gold was the 10-year TIPS rate, which reflects the 10-year expected real interest rate (“real rate,” in short) of US government bonds.

The physical gold price was predominantly set in the London Bullion Market and to a lesser extent Switzerland. Gold trade in London can be divided into three categories:

- Institutions buying and selling “large bars” (weighing 400 ounces) outright.

- Trading in large bars via Exchange-Traded Funds (ETFs).

- Arbitragers buying and selling in London to profit from price discrepancies between the COMEX futures price and London spot. In this sense, London serves as a warehouse for the COMEX futures exchange.

As we will see below, the TIPS rate, UK net gold import (positive or negative), Western ETF holdings, and the COMEX open interest were all correlated to the price of gold. Until the war in Ukraine broke out late February 2022, that is, and things started to change.

Because customs data lags a few months, and the World Gold Council’s supply and demand data is published quarterly, we will cover the global market until June 2023 in this article. We will examine how gold is becoming less sensitive to real rates, and how London is losing its gold pricing power.

The West is Losing its Gold Pricing Power

Let’s start by reviewing the correlation between real rates and gold. Note, the TIPS yield axes in the charts below are inverted because higher rates caused lower gold prices and vice versa.

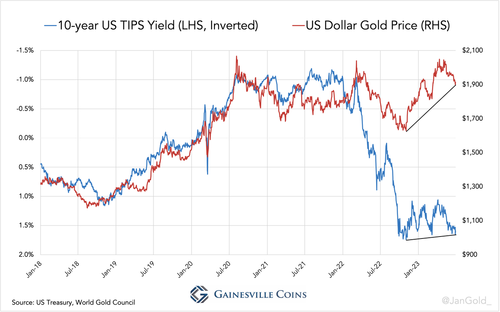

From March until September 2022 the TIPS yield rose dramatically (down in the chart), but the price of gold reacted less bearish than the “rates model” previously prescribed. As London was still a net exporter over this time horizon, I conclude the West was still in charge of the price. But then came the third quarter of 2022.

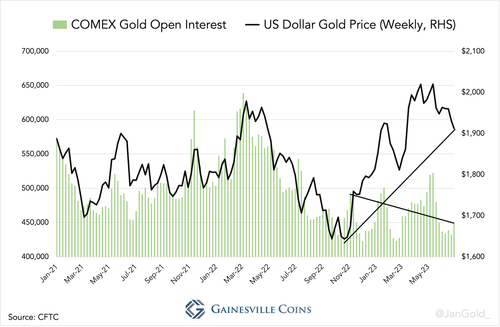

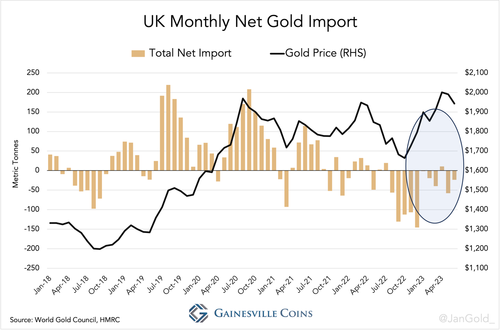

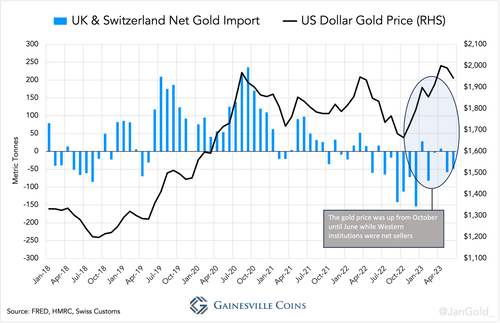

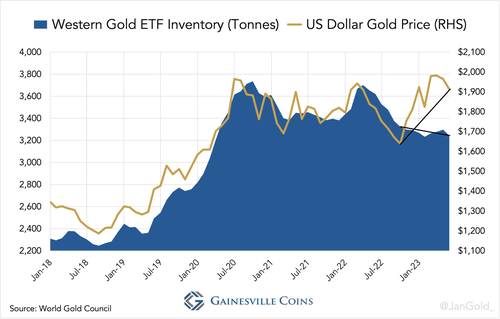

From late October 2022 until June 2023 the TIPS rate was barely down while gold was up 17%. Remarkably, the West wasn’t driving up the gold price, as demonstrated by UK net exports, declining Western ETF inventory, and falling COMEX open interest.

First, the UK’s monthly net flows. Obviously, the price wasn’t set in London, as the UK was a net seller while the price was up. In Chart 1 and 4 you can see this is unprecedented.

Also taking into account gold flows through Switzerland, the second largest Western physical gold market and largest refining hub globally, shows a similar picture. For the first time since monthly data is available, the gold price has been rising over several months while the UK and Switzerland combined are net exporters.

Not surprisingly, Western ETF inventory, of which the majority is stored in London and Switzerland, has declined over the past three quarters.

Western institutions that trade gold outright or use ETFs are dominant on the COMEX futures exchange as well. At the COMEX we see the same development: gold’s open interest has fallen over the period in question.