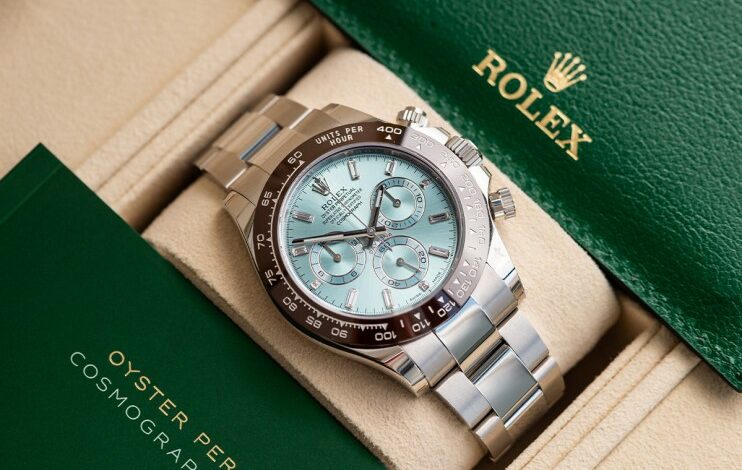

The Luxury Watch Market Bubble Has Burst. What Next for Rolex, Patek Philippe and Audemars?

After a post-pandemic downturn in the luxury watch market, manufacturers have limited supply to shops to avoid a glut of merchandise in the market.

The pandemic-era boom, which saw luxury watch prices rise by 20 per cent in just the fourth quarter of 2021, is now over.

“[The bubble wasn’t] something that we’ve seen before in the watch market,” a watch seller told City AM last month.

“I’m definitely seeing quite a lot of new models coming onto the market – as in freshly dated within this month and the last month,” Joel Faith, director of Atlas Watches, said.

“I think a big part of it is down to how the authorised dealer dynamic has changed. Previously they could call up a customer for any watch and have it sold.

“Whereas nowadays that’s not the case because a large volume of their stock trades below retail price – some of it quite considerably below retail price – and their customers aren’t really aren’t buying those watches,” Faith added.

Chief executive officers of watch manufacturers told participants of a trade show last week that they will limit shipments to prevent retailers from holding on to a glut of inventory, in an effort to protect themselves against further price drops and brand erosion, according to Bloomberg.

“The hype is over because there is too much merchandise,” Frank Müller, an industry consultant at Germany-based The Bridge to Luxury who previously ran the Swatch Group brand Glashütte Original.

A high supply of watches may lead to discounting at stores at they tried offload stock.

A popular way to do this is for retailers to sell “bundles” of watches to buyers containing a hard-to-obtain timepiece from brands like Rolex and Patek Philippe. This could lead to the lower-priced watches being “dumped” on the second-hand market, hurting brand value.