PlanB Predicts Bitcoin Price of $100,000-$1MILLION in Next 2 Years

Quant analyst PlanB says that a 10x price increase for Bitcoin (BTC) is in the cards as many of its key indicators have flipped bullish.

In a new video update, the closely followed on-chain analyst tells his 89,400 YouTube subscribers that he doesn’t expect Bitcoin to have diminished returns, or lesser gains than the previous cycle due to BTC adoption still being in the early stages.

“[Bitcoin’s growth used to be] 100x in the first couple of bull markets, but lately that has slowed down a little bit to 10x, a little bit under 10x.

I don’t expect diminishing returns because we’re at 2 or 3% adoption, and if we follow the logistic S-curve and Metcalfe’s law, we can’t have diminishing returns below 50% adoption, so we’ll have exponential growth for a couple more years. I expect a nice 10x that brings it to somewhere in the [$100,000 to $1 million range].”

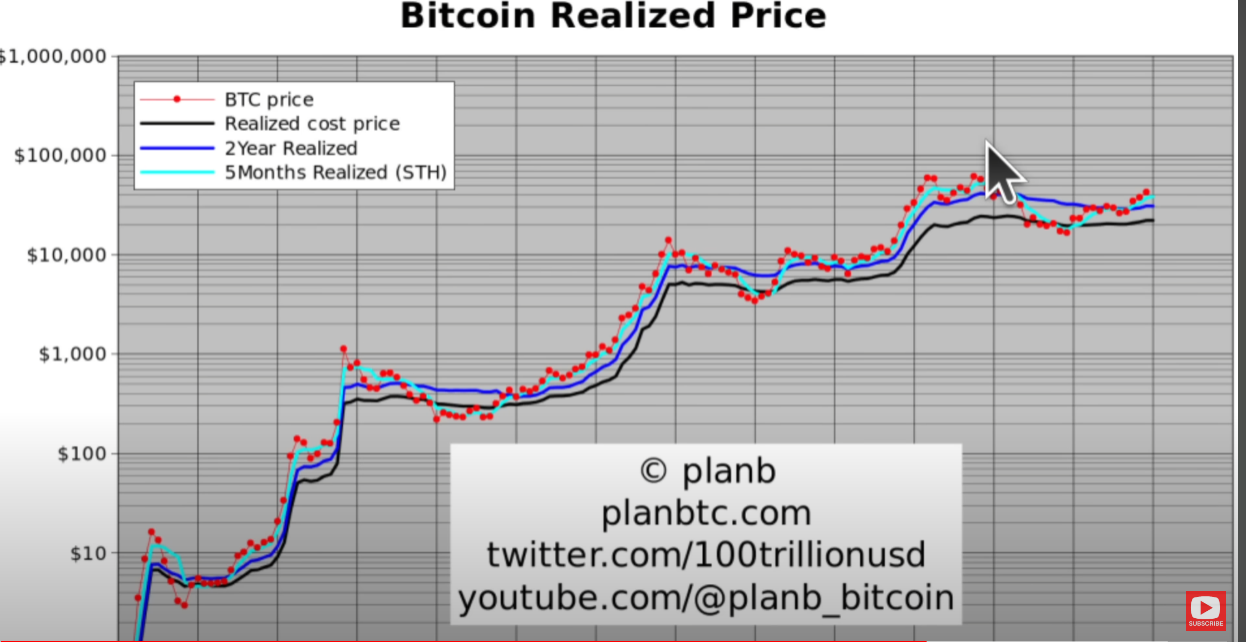

PlanB also looks at his model that aims to pinpoint the stages of Bitcoin’s market cycles by analyzing the cost basis of the majority of BTC in circulation. According to the analyst, Bitcoin is now crossing above the average cost basis of coins, which is a “hallmark” bull run signal.

“So right now, we’ve left the bear market of 2022 behind us, Bitcoin’s price crossed all the cost prices, so a lot of people are in profit right now and Bitcoin is above the cost prices and the cost prices are rising, especially the realized price, which is going up again, which is a hallmark signal of a bull market that is starting.

Where will that bring us? Probably in this $100,000 to $1 million area if history is any guide.”

Looking at the analyst’s chart, Bitcoin’s price appears to be hovering above its realized cost price, two-year realized cost price and five-month realized cost price. The realized price is the average price of all Bitcoin in circulation calculated based on the price at which they were last moved.